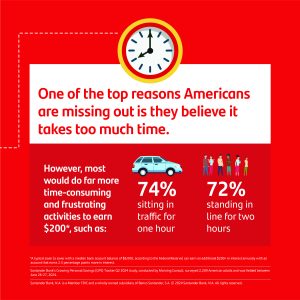

- 74% of Americans would sit in traffic for an hour to earn $200, but only 16% took the time to move money to higher-yielding accounts.

- As expense pressures mount, 44% of Americans missed their savings goal in June, up from 35% in March.

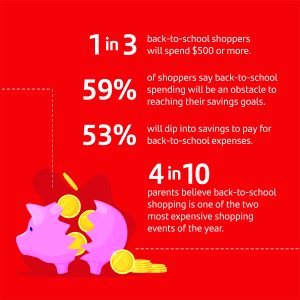

- Six in 10 back-to-school shoppers across the U.S. expect it will impact their ability to meet their savings goals.

Santander Bank, N.A. (“Santander Bank” or “the Bank”) announced today the findings of its second Growing Personal Savings (“GPS”) Tracker, a research series exploring Americans’ approach to building and managing their savings. While many Americans have been adding to their savings month-over-month, the overall percentage doing so each month dipped in Q2. The survey found expenses stemming from back-to-school shopping and energy costs over the summer will further impact households’ ability to save.

As Americans contend with these added financial burdens, many are missing out on a simple and convenient opportunity to ease expense pressures by earning more interest on their savings. A typical American saver[1] could earn an additional $200 by moving money to an account that earns a higher rate of interest, but certain misperceptions have prevented many from making their money work for them. For example, half of Americans do not realize savings rates are the highest they have been in about 15 years, and some believe it takes too much time to make a change. Yet, Americans would be willing to do much more time-consuming and frustrating tasks for $200 — such as sitting in traffic for one hour (74%) or standing in line for two hours (72%).

“Americans remain resilient in the face of continued financial challenges, but many are missing out on the opportunity to earn more with higher interest rate accounts due to general lack of awareness. Our research uncovers both the opportunities and challenges confronting Americans, which helps Santander Bank as we continue to innovate and update our platforms, products and services to enhance engagement and support our customers in achieving their financial goals.”

Tim Wennes

Santander US CEO

Savings Slow in Q2, and Upcoming Bills Pose Further Challenges

The GPS Tracker shows many (54%) savers added to their savings balance each month in Q2, though down from 60% in March, and 44% of those with a savings goal missed their target in June, up from 35% in March. Americans also fell short of their tax refund savings expectations this year. While 86% planned to save some portion of their tax refund, only six in 10 had done so, and those who did were generally saving a smaller proportion than planned. Expenses played a major role in these shortcomings, with too many bills or financial commitments being the top obstacles to saving in Q2.

Additional barriers to saving lie ahead, as Americans contend with energy costs and a looming back-to-school shopping season. Four in 10 say they will spend on back-to-school shopping, with one in three planning to spend $500 or more. More than half of back-to-school shoppers (53%) will dip into their savings to cover purchases, and six in 10 believe back-to-school shopping will be an obstacle to their savings goals. Most parents with children under age 18 (85%) will incur back-to-school shopping expenses, with four in 10 (41%) saying it is one of the two most expensive shopping events of the year. Adding to the stress this summer are rising energy costs, with 63% identifying them as a barrier to saving.

Americans Lack Sufficient Emergency Savings

Many Americans lack sufficient emergency savings, with nearly half (48%) unable to cover a $2,000 emergency expense from savings, and less than half (49%) having contributed to their emergency savings in the past three months. While many financial experts recommend high-yield savings accounts for growing rainy-day funds, less than one-quarter (22%) who contributed to their emergency savings in the past three months have such an account. Unexpected expenses were cited as a major savings obstacle in Q2, highlighting the importance of being prepared.

Methodology

This research on growing personal savings, conducted by Morning Consult on behalf of Santander Bank, surveyed 2,209 American adults. The Q2 study was conducted between June 26 – 27, 2024. The interviews were fielded online, and the margin of error was +/- 2 percentage points for the total audience at a 95% confidence level. This data was weighted to target population proportions for a representative sample based on age, gender, ethnicity, region, and education. Percentages may not equal 100 due to rounding. Monthly measures were based on additional monthly survey pulses, conducted by Morning Consult on behalf of Santander Bank, of ~2,200 Americans adults.

The full Q2 report and more information about the Santander Bank, N.A. survey can be found here.

[1] According to the Federal Reserve, the median savings in bank accounts is $8,000. Earning 2.5 percentage points more interest annually would equate to about $200 for these typical savers.